Streamline your insurance claims processing

with AI-powered call analysis specifically for claims management.

Did you know that insurance fraud costs American consumers over $308.6 billion every year, and occurs in about 10% of property-casualty insurance losses?

From initial loss reports to management and administration, the way the insurance industry processes claims has changed very little over the past decade. Today, however, TRAQ is disrupting insurance claims management — for the better.

How are we doing it?

Insurance claims typically take about one month to resolve, depending on the state and type of claim. TRAQ makes every minute count, by reducing your overall claims call effort while increasing accuracy and efficiency.

Our unique artificial intelligence platform works seamlessly with your claims team – analyzing each call to identify facts, reduce disputes, and detect potential fraud.

Evaluate insurance claims faster while reducing overall management cost.

Auto-generate call notes and call fraud reports within a centralized system.

Receive alerts when the system identifies potential fraudulent intent.

Learn exactly how your top performers are completing successful calls.

Discover specific areas to improve your claims interview process.

Insurance claims teams often face complicated scenarios

With over 5,900 insurance companies in the United States alone, the sector is complex and highly fragmented. In this environment, accurately capturing information throughout the lifecycle of a claim is more important than ever – you shouldn’t be struggling to provide your team with the tools they need to improve efficiency and accuracy!

TRAQ can record, transcribe and analyze calls between the insured, the insurance company, other adjusters, the agent and the claims call center – reducing the chance of errors and saving countless hours.

Ensure more accurate claims-processing by recognizing low-risk requests and identifying high-risk claims faster than ever before. Our technology will help close the gaps in your team’s processes to improve outcomes and provide better all-around service.

Achieve excellence with innovative automation

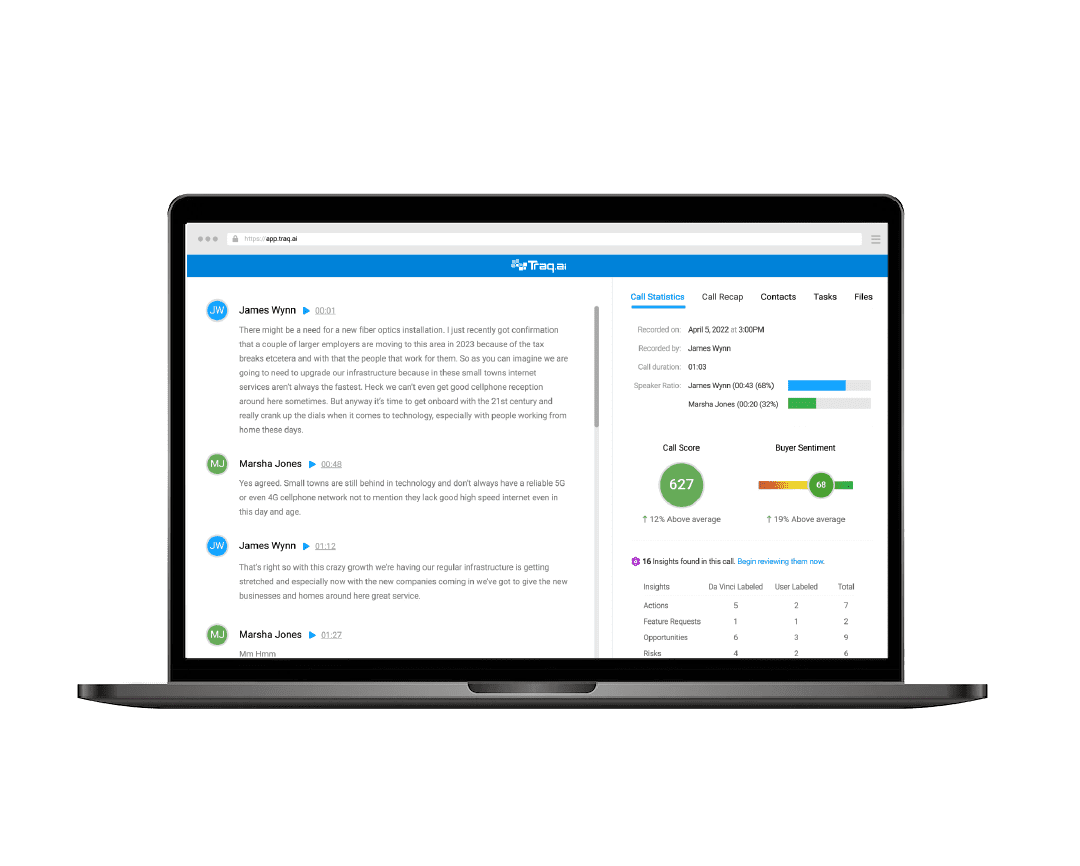

Instead of adjusters, underwriters or claims intake processors typing copious notes as the claimant (or involved party) describes a claim, the conversation is recorded, transcribed and then analyzed. TRAQ can monitor everyone simultaneously and analyze in real-time, allowing you to understand each claim on an entirely new level.

Here’s how it works

TRAQ illuminates each insurance claim your team handles.

Record

Every call will be recorded and transcribed, then sent directly to the claims management system for documentation.

Analyze

TRAQ’s Conversation Intelligence tool listens to every word spoken to reveal red flags and action items.

Learn

Identify areas of concern and fraudulent intent patterns you may have missed on your own, while ensuring every word is documented for future reference.

Record

No-Fuss Transcriptions

By analyzing data from each initial claims call, TRAQ highlights key information and issues that are important to the case, and any critical details that the adjuster or insurance company should know about and take action on.

In addition, our handy calendar integrations ensure you automatically capture every scheduled Zoom, Teams, and Google Meet call.

AI Note Taking

Claims management is an administrative-intensive endeavor with many repetitive and manual tasks. TRAQ takes notes for you during each call, so you can give undivided attention to the claim itself. You can then link to your TRAQ meeting notes directly from your CRM contacts – freeing up an average of 8-12 hours of admin time each week!

Instant Summaries

Prepare to increase productivity and accuracy while reducing operational costs. After every meeting, TRAQ generates a summary of the transcript with key takeaways – making it easy to prepare for future calls and giving leaders the ability to catch up quickly on the status of each claim being processed.

Analyze

Conversation Intelligence

onversation Intelligence (CI) is a form of AI based on Natural Language Processing (NLP). What does this mean, exactly? TRAQ can find important words and phrases in your conversations and extract specific insights from them.

Conversation Intelligence ensures nothing gets missed.

Remember, TRAQ is listening and learning from every call. It catches the subtle nuances that are often overlooked, identifies gaps in the claims handling process, uncovers previously unseen concerns, and more.

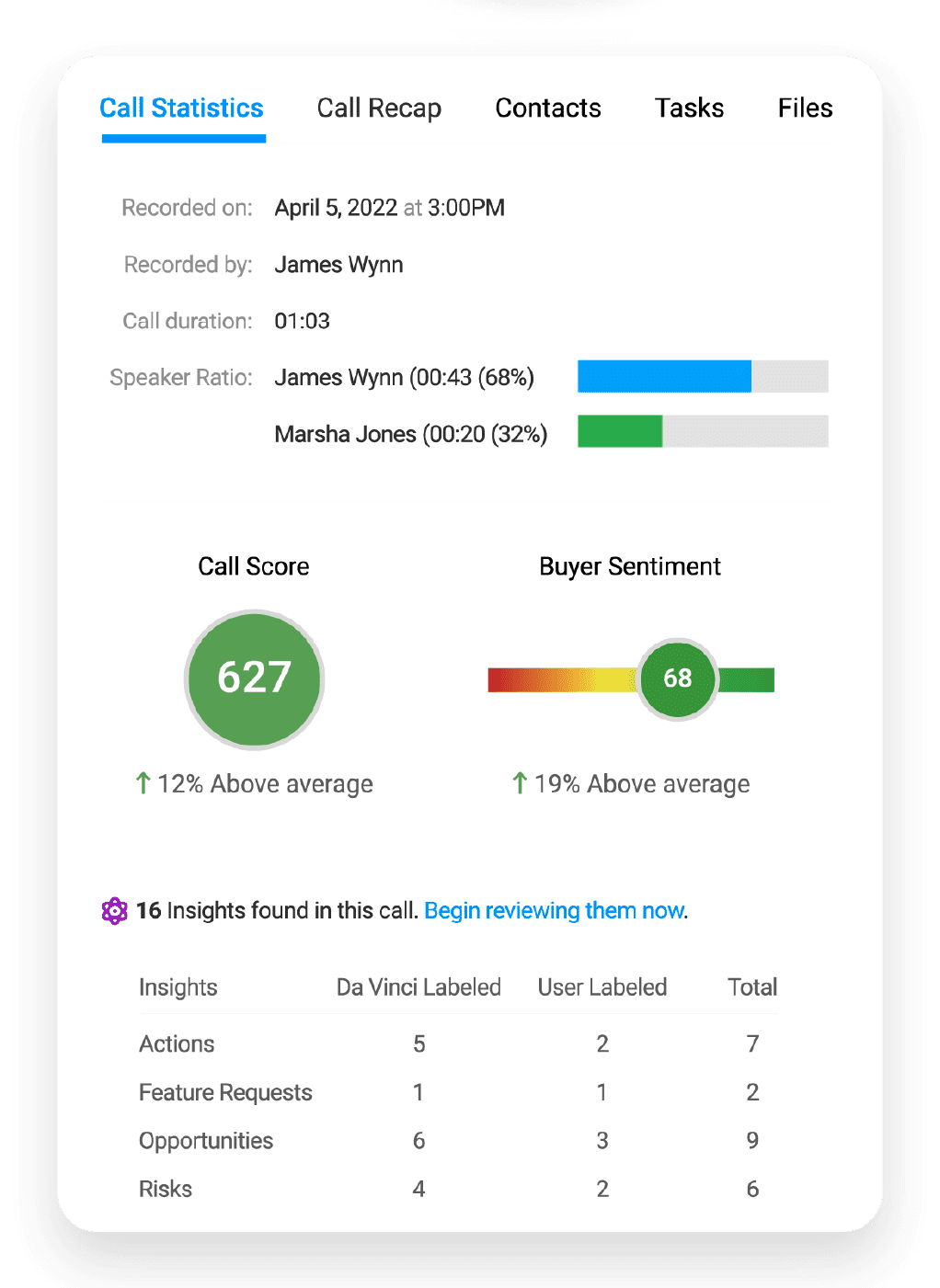

Objective Call Scores

With AI gathering massive troves of data from your conversations, the result is an objective, unbiased system to score your calls – enabling realistic settlement forecasts when evaluating your pipeline. It makes it easy to run reports, understand the status of each account, and make strong strategic decisions about where to focus your team’s efforts.

Learn

Superpowered Claims Management Team

The insights found and categorized by TRAQ help you understand your audience like never before. Identify intent, unlock a new understanding of each claimant’s priorities, and track them as they change over time. Meanwhile, TRAQ keeps learning from each one of your team’s recorded conversations.

Accurate Forecasting

Make fact-based projections thanks to a complete view of each claim being processed. Run Opportunity Reports to quickly see the status of every account and intervene where needed.

View a brief demo of TRAQ

We’ll give you a tour of our features and show you how easy it is for any insurance professional to use.

Here are your next steps.

Try TRAQ for Free

You don’t have to pay for TRAQ until you start to see its impact on your claims handling.

Add TRAQ to Your Calls

You don’t have to pay for TRAQ until you start to see its impact on your claims handling.

Use it to Coach Your Team

- See the insights for yourself and use this advantage to stay ahead of the competition.